We get asked a wide variety of questions about Centrelink, Services Australia and eligibility for benefits. We attempt to provide a clear and simple response while remembering that everyone’s situation is different.

On this page you can find a few frequently asked questions

At PensionHelp we’re here to help and welcome your questions whether you are a client or not.

Please use the form below if you cannot find an answer to your question.

Questions about PensionHelp

PensionHelp is a leading Centrelink administration company.

As our name suggests, we are here to help you. We use the latest technology to make assessments as smooth as possible by simplifying the process, saving you time and ensuring that you receive the benefits you are entitled to.

We are an Australian organisation driven to supply services centred around our core values of Trust, Genuine Care and Community Growth. Our team have expertise with Centrelink and Services Australia, having spent years working inside Centrelink and focusing on Centrelink benefits and the claiming process. Together we have assisted and supported millions of Australians across the country for the past three decades to make informed decisions about their financial future.

We fully appreciate the complexity of Centrelink and a key part of our service is not just about obtaining your benefits, but also ensuring your information is kept up to date with Centrelink and resolving any issues.

We are Centrelink experts. The team has many years of experience either working directly in Centrelink or supporting people like you.

With a simple and affordable service, PensionHelp will:

- Ensure you receive exactly what you are entitled to

- Provide expert support every step of the way

- Rid you of confusing forms

- Help you avoid the queues or hours on the phone to Centrelink

- Save you stress and time

- Speed up your payments

- Keep your information updated for correct assessments

- Identify what other entitlements you could claim

We talk to Centrelink for you so you have more time to enjoy life.

We have made this process as simple and easy as possible for you.

Step 1: Your details

Our process will save you a lot of time and hassle and (thankfully!) it will relieve you from answering hundreds of questions on various Centrelink forms.

You will need to gather some basic details and statements for your current accounts. It helps to have the following documents ready:

- Driver licence

- Passport or birth certificate

- Current bank statements

- Investment and share statements

- Superannuation statements

- Pension schedules for any income streams

- Rates notice for any investment real estate

- Rent agreement

Our process makes it easy to upload these to your account but you can always email or text these to us if you need to. You can contact us to arrange the best way to collect your information.

Step 2: We apply on your behalf

We ensure your online claim is complete and correct so it is processed quickly and not rejected like many self-completed and complex claims.

As PensionHelp becomes your correspondence nominee, we will:

- Commence your claim online

- Submit your claim online

- Follow up and talk to Centrelink on your behalf

Over the years we have found clients appreciate not only the time we save them from dealing with Centrelink, but also our extensive knowledge and personalised service.

Step 3: One simple visit to Centrelink

PensionHelp will minimise your dealings with Centrelink however, you will have to visit Centrelink just once to complete an ID check. We will help you with this process when the time comes.

If you are already receiving a benefit then there is no need to visit Centrelink.

Step 4: We liaise with Centrelink

To save you time and hassle, PensionHelp is your correspondence nominee and will work directly with Centrelink on your behalf. If further information is required we will speak to you regarding what exact information is required and why.

We will receive copies for any requests for further information and work with you to have your pension granted and ensure you receive the right payment.

Step 5: Your pension starts sooner

98% of PensionHelp claims are accepted at the first attempt and, due to our deep knowledge of the Centrelink system and pension requirements, additional questions are answered quicker allowing for your pension to start as soon as possible.

Step 6: Your ongoing benefits

PensionHelp is here to support your ongoing needs. As your account balance changes and the Age Pension rules are updated, we will work with you to ensure you maximise your entitlement every year.

Of course, if you have any questions about this process and of your specific circumstances please email us at support@pensionhelp.com.au.

We aim to keep our business efficient so it can offer a simple and affordable service. The service costs range from $398 to $697 for most claims and $398 to $548 for a reassessment. Our prices include GST Please review our pricing page for more information or contact us.

You do not need to come into an office to deal with PensionHelp. If you have any questions, contact us.

It can take as little as 15 minutes to complete the online application. We do recommend that you have relevant information at hand. Naturally, complex situations may take longer.

Once the nominee arrangement is in place, we will liaise directly with Centrelink on your behalf and advise accordingly.

We have built the PensionHelp platform using the latest technology to make it as simple and easy to use. You will need to provide some or all of the following information.

- Driver licence

- Passport or birth certificate

- Current bank statements

- Investment and share statements

- Superannuation statements

- Pension schedules for any income streams

- Rates notice for any investment real estate

- Rent agreement

The step-by-step process will tell you when certain information is required.

Our calculator provides an estimate of your eligibility for the Age Pension. The information you provide needs to be assessed against Centrelink eligibility rules in greater detail.

There could be a number of reasons;

a) More information may be required to assess your situation.

b) You may not yet have reached the age criteria. Many clients want to find out their status in advance. We are here to support you when the age criteria is met.

c) You may not be an Australian citizen, or the information about your citizenship has not been correctly recognised by the Centrelink criteria.

There are many reasons. If you think you should be eligible, simply send us an email at support@pensionhelp.com.au.

If you are in a relationship, married, de facto or separated by illness, Centrelink will view you as a couple and need to know both your financial and personal details. This is the same even if only one member of the couple is applying. PensionHelp will be required to process a higher amount of data to complete your service.

In simple terms, it’s part of Centrelink’s asset and income test when determining your entitlement. If you are not sure, please contact support@pensionhelp.com.au

You can pay by credit or debit card (Visa, Mastercard and American Express), Apple Pay or Google Pay, PayPal or bank transfer.

Learn about PensionHelp pricing here.

You will be emailed a receipt for your plan when your payment is received. This receipt can also be used as a tax invoice. Please contact us if you don’t receive this receipt and we can send a copy to you.

You can also download an invoice from the payments section of your Account.

Stripe is a secure, online payment system that PensionHelp uses to process credit or debit card payments for subscriptions.

Stripe processes billions of dollars a year for thousands of businesses. Web and mobile businesses using Stripe include Amazon, Twitter and Shopify.

Simply email us at support@pensionhelp.com.au.

PensionHelp takes your privacy seriously and we have installed a number of processes to ensure your information remains secure at all times. Please visit our privacy policy for more information. If you have any questions, email support@pensionhelp.com.au.

We’re always seeking to improve our service offering and welcome any feedback about our service. Please send an email to support@pensionhelp.com.au.

Go to this page to login.

We recommend you tick the Remember Me box to extend the period that you stay logged in for.

Your username will be the email address that you signed up with. Please contact us if you cannot remember the email address you used.

If you’ve forgotten your password, click the Forgot Password link below the Log In button on the login page.

You will then be prompted to enter your email address. You should then click the Request Password Reset button.

You will then receive an email with a link. Once you click that link you can enter a new password.

Please contact us if you have any issues with any of the above.

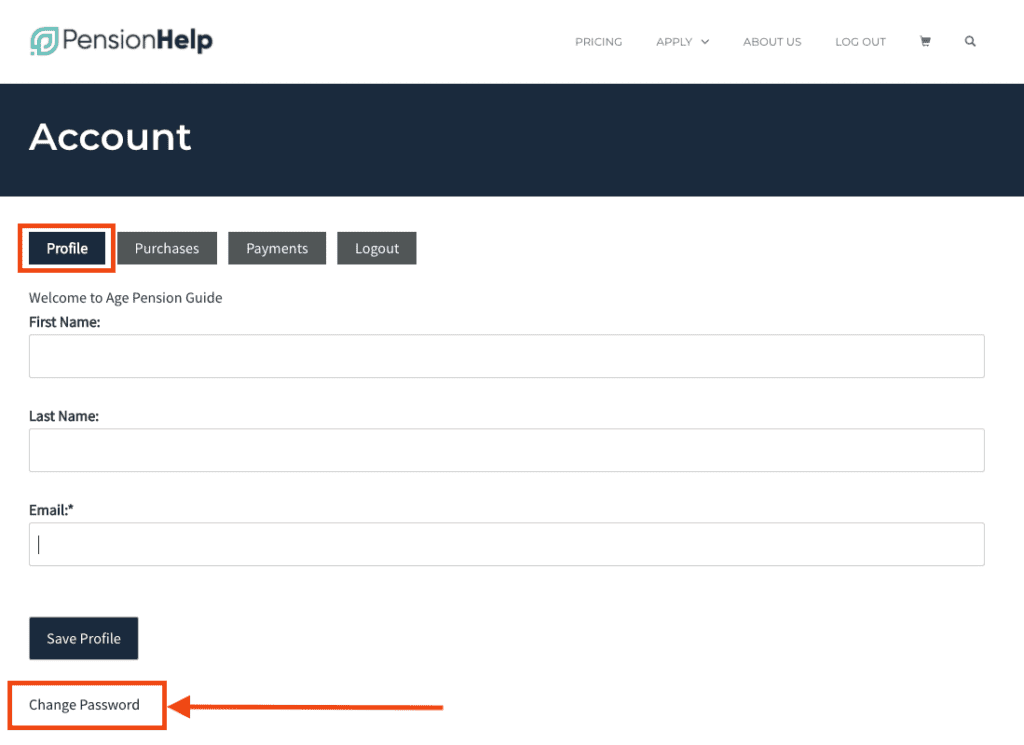

You can change your password within your PensionHelp account page.

Click Profile, and then at the bottom you will find a link to Change Password. Simply click this and follow the instructions.

Questions about Centrelink, the Age Pension and other benefits for seniors

There is no law that stipulates when someone can retire in Australia. In fact, you can choose to retire whenever you want, however this will not fast track any Age Pension entitlements.

If you cease work before your Age Pension age and still require assistance, you may need to consider Jobseeker. Please contact us to discuss this option.

This is 66 and 6 months for those born between 1 July 1955 and 31 December 1956

The qualifying age for Age Pension has been increasing from 65 to 67 years since 1 July 2017. On 1 July 2023 Age Pension age will increase to 67.

The Commonwealth Government provides income support payments for eligible Australians to help maintain standards of living in retirement. You may still be eligible if you are earning an income so use our calculator to check.

Payment rates (for September 2021) can be up to $967.50 per fortnight ($25,155 per year) for singles and $1,458.60 per fortnight ($37,923.60 per year) for couples inclusive of supplements.

Centrelink will allow for you to apply for the Age Pension or Commonwealth Seniors Health Card as early as 13 weeks in advance of your Age Pension age.

Yes. While your income will form part of your means testing, you can still apply. Check your eligibility on our calculator.

Even if you don’t meet criteria for the Age Pension, you may be eligible for a Commonwealth Seniors Health Card, which provides access to various concessions and discounted medicines. You can visit the Services Australia website for more information about this or contact us.

A concession card to get cheaper health care and some discounts if you’ve reached Age Pension age.

To get this card you need to meet some conditions. You must:

- Be Age Pension age

- Meet residency rules

- Meet the income test.

To meet the income test, from 20 September 2021, you must earn no more than the following:

- $57,761 a year if you’re single

- $92,416 a year for couples

- $115,522 a year for couples separated by illness, respite care or prison.

Read about concessions available in your state or territory on their websites:

Australian Capital Territory – ACT Assistance

New South Wales – NSW Government Community Support

Northern Territory – NT Pensioner and Carer Concession Scheme

Queensland – Concessions

South Australia – Disability concessions and entitlements

Tasmania – Discounts & concessions

Victoria – Concessions & benefits

Western Australia – ConcessionsWA

Please contact us for more details on benefits like:

- Carer Allowance and Payment

- Jobseeker

- Low Income Card

- Disability Support Pension

Yes, that’s what PensionHelp does! This is done through a correspondence nominee arrangement. Over the years we have found clients appreciate not only the time we save them from dealing with Centrelink, but also our extensive knowledge and personalised service.

Electing PensionHelp as your correspondence nominee will ensure applications, updates or other requests are handled in the most efficient and effective way.

Yes, of course you can!

You may be interested to know the 2020 statistics regarding Centrelink:

- Over 5 million claims

- Over 46 million telephone calls

- Over 14 million visits to service offices

PensionHelp is highly experienced at navigating the Centrelink process in a timely and accurate manner. Leave it to us so that you can spend time with family, friends and enjoying your well earned retirement.

Centrelink is flooded with over 46 million telephone calls per year and this number is increasing every month. The PensionHelp service uses expertise to navigate the system and act directly with Centrelink on your behalf.

If you are not already registered for benefits, you may need to visit a Centrelink office.

When we are ready to follow up your Centrelink claim we will contact you with our only request for you to visit Centrelink.

We need you to present two forms of identification to your local Centrelink Office.

You’ll need to provide one document from each of these categories:

- A commencement document to show your birth or arrival in Australia (eg Australian birth certificate, Australian passport or Australian visa or Australian citizenship certificate)

- A primary document to show the use of your identity in the community (eg driver Licence, foreign passport, proof of age Card, marriage certificate).

At least one of these must be a photo identity document.

Please contact us if you would like to discuss alternative forms of identification or if you have any questions.

If you are in a relationship, married, de facto, or seperated by illness, Centrelink will view you as a couple and need to know both your financial and personal details. In simple terms it’s part of Centrelink’s asset and income test when determining your entitlement. If you are not sure, please contact support@pensionhelp.com.au

You can normally receive the Age Pension for the whole time you’re outside Australia. Even if you live in another country for a while. In some circumstances like extended trips, your benefit may reduce.

However, it’s best to tell Centrelink if you’re leaving Australia if any of these apply:

- You’re going to live in another country

- You’ll be away longer than six weeks

- You receive a payment under a social security agreement with another country

- You returned to live in Australia within the last two years and started getting the Age Pension since then.

Otherwise you don’t need to tell Centrelink about your travel. The immigration department will tell Centrelink when you leave and return.

It’s best to tell Centrelink if you move overseas and your benefit may reduce.

If you want to apply while you are overseas, please contact us via email when completing your claim with PensionHelp.

If you have lived in another country, you may also be able to claim overseas benefits.

This sometimes happens and it could be as simple as Centrelink misunderstanding your situation or certain information has not been provided to Centrelink or processed correctly by Centrelink.

If this happens, let PensionHelp know. There may be a simple fix at no extra charge.

On occasion, additional work may be required. We will keep you informed and if additional charges may be incurred, we will let you know beforehand.